Manage the Plastic Tax with SAP

What is the Plastic Tax and its objectives?

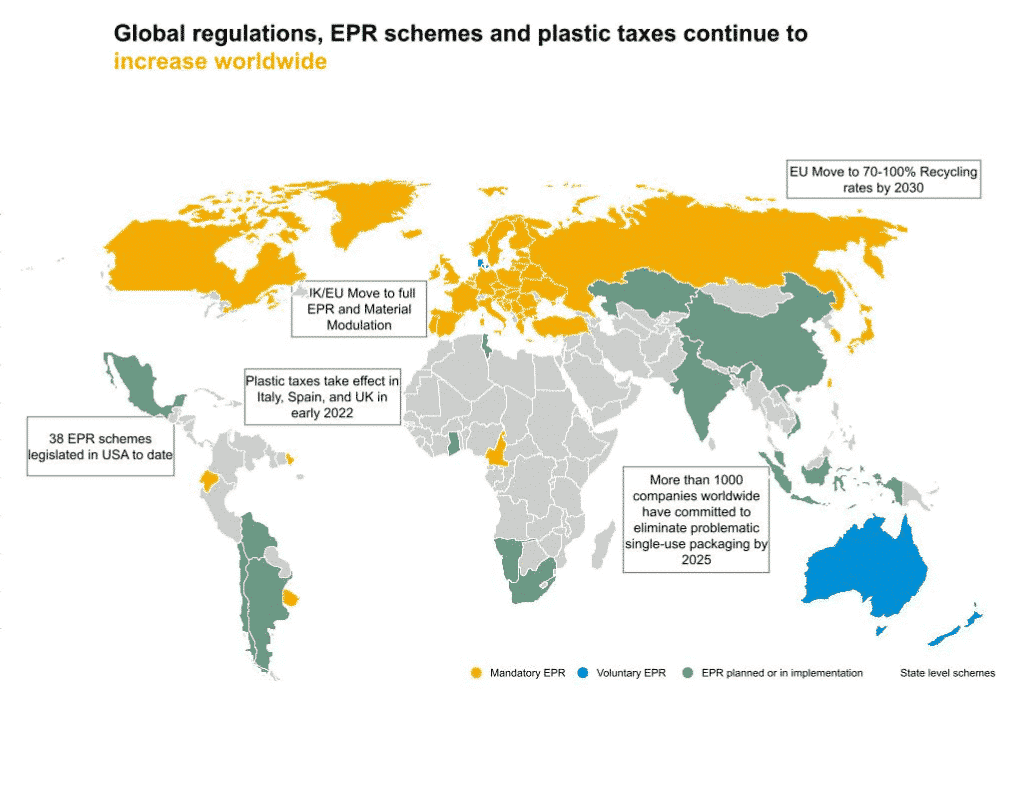

In April 2022, Law 7/2022, of April 8, on waste and contaminated soils for a circular economy, was published in the Official State Gazette (BOE). It introduces fiscal measures with the ultimate goal of encouraging the circular economy, including the creation of a new excise tax on non-reusable plastic packaging,

The new regulation came into force on January 1 and is presented as an indirect tax on the use of non-reusable packaging containing plastic, whether it is empty, or whether it is presented containing, protecting, handling, distributing and presenting goods.

It also establishes that its purpose is to promote the prevention of the generation of non-reusable plastic packaging waste, as well as to promote the recycling of plastic waste, contributing to the circularity of this matter.

The new tax affects the entire industry with a tax rate of 0.45 euros for each kilogram of this material that it manufactures or acquires. But it also affects almost any company that uses this type of packaging for its products and, in addition, consumers, since this extra cost could be passed on in the price of their products.

Companies that fail to comply with the plastic tax face financial penalties. Those that have not registered will be penalized with a fine of 1,000 euros and those that have declared an incorrect quantity of taxable packaging with 75% of the quantity produced (100% in the case of repeat offenses) + 1,000 euros.

Scope of the Plastic Tax

The new plastic tax affects companies that manufacture, import or make acquisitions within the European Union of non-reusable plastic packaging whose final destination is the Spanish market.

- Non-reusable containers containing plastic.

- Semi-finished plastic products destined to obtain the above containers, as well as thermoplastic preforms or sheets.

- Products containing plastic intended to enable the closure, marketing or presentation of non-reusable containers.

Plastic Tax Exemptions

In order to calculate the levy, companies will have to report on the exact amount of plastic in non-reusable packaging, which means that they will have to know detailed data on the packaging and on the materials used in its manufacture, regardless of where it was produced.

This implies traceability of the entire production and logistic process of the product. Another challenge they will have to face is compliance with the invoicing requirements of the law, which affect both the producer and the buyer.

- Manufacture, importation or intra-community acquisition of products related to medicines, medical devices, food for special medical uses, infant formula for hospital use, or hazardous waste of hospital origin. The declaration of the addressee is required.

- Manufacture, importation or intra-community acquisition of plastic rolls used in bales or bales for silage of fodder or cereals for agricultural or livestock use.

- Intra-Community acquisition of products destined to be shipped outside the territory where the tax applies.

- Intra-Community acquisition of products that are no longer suitable for use or have been destroyed.

- Import and intra-community acquisition of packaging, provided that the total weight of non-recycled plastic contained does not exceed 5kg/month.

- Manufacture, importation or intra-Community acquisition of semi-finished plastic products for obtaining plastic containers or products intended to allow the closing, marketing or presentation of containers, when they are not to be used for such purposes.

How to calculate the amount of Plastic Tax?

Once the Law has been approved, the management of the tax has been established to be through the filing of returns, registration or compliance with accounting obligations:

- Each taxpayer, once registered in a territorial registry, will be assigned a CIP number (Plastic Identification Code). Importers are exempted, as are intra-Community purchasers who only make exempt purchases that do not exceed the threshold of 5 kg of plastic in a month.

- Non-established taxpayers must appoint a representative before the Tax Agency, who must also be registered in the Territorial Tax Register.

- Taxpayers who are manufacturers or intra-Community purchasers must file a monthly or quarterly self-assessment, depending on their VAT settlement period.

- Imports shall be settled by means of the customs declaration itself, in which, in order to facilitate subsequent settlement by Customs, the weight of the non-recycled plastic of the subject product that has been imported (or if an exemption applies) must be stated.

- Manufacturers must keep accounts of the products obtained, while intra-Community purchasers (except those who only carry out exempt operations for not exceeding the threshold of 5 kg. per month), must keep a stock book.

Managing Plastics Tax with SAP

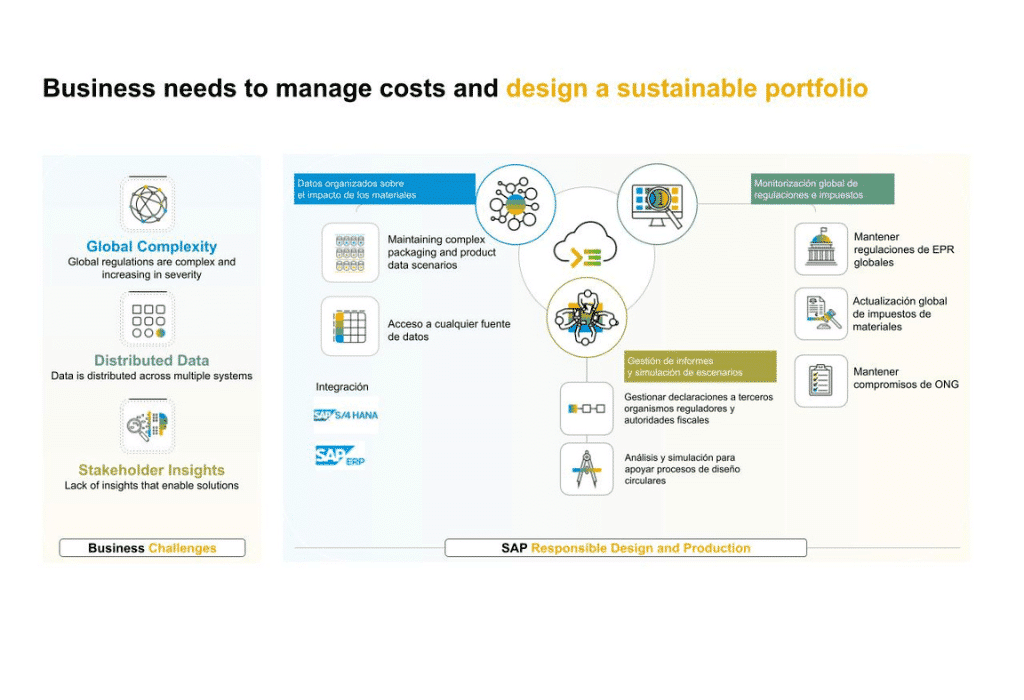

SAP Responsible Design and Production is an SAP software solution that helps companies design and produce products in a more responsible and sustainable way. This solution helps companies manage and reduce the use of non-recyclable materials, minimize resource waste, and increase energy efficiency. It also helps companies reduce their carbon footprint by producing products with lower emissions.

In terms of plastics tax management, SAP Responsible Design and Production helps companies manage plastics tax efficiently. Identify the plastic materials used and determine the tax payable on them. Facilitates regulatory compliance, laws and regulations established by different governments.

SAP Responsible Design and Production Features

SAP Responsible Design and Production highlights include:

- Materials management..: Identifies and controls the materials used in your products.

- Tax management.Management of taxes related to the plastic and determine the tax to be paid.

- Sustainability analysis. It allows companies to assess the sustainability of their products and determine alternatives to reduce environmental impact.

- Emissions reduction. Reduced carbon footprint by producing products with lower emissions.

- Waste reduction. Minimizes resource waste by reducing the use of non-recyclable materials.

Why SAP Responsible Design and Production

SAP Responsible Design and Production collects material and logistics data, provides the ability to capture detailed information on packaging composition, and enables the simplification and automation of manual reporting processes.

SAP’s ta solution also has capabilities to reduce compliance risks, while enforcing tax changes and updates and optimizing the choice of packaging materials to reduce these taxes and drive circularity, which is the ultimate goal of this levy.